Calculator Dashboard

IMPORTANT: For ALL LENDERS the maximum loan is based on the lowest ICR & Stress rate. This will always have the highest product fee. Same lender can have a lower fee and a lower alternative rate. Once suitable lender is identified we advice lender’s other rates are checked. Then the manual calculator (Section 3 & 4) can be used to the refine the results.

A useful trick: once you identify the lender with full rental income, run the calculation with lower rent. If the same lender can still lend the required loan, it is likely the lender will have a lower rate with lower fee. Check their rates.

Video guide loan calculator

Section 1 : This row sets the loan requirements. Input data except Loan Required field (shows the loan based on selected LTV). LTV is a drop down menu with stepped 5% changes. Standard LTV demarcation used by lenders.

Section 2: Client Criteria Selection

A. Applicant Tax Band – select applicable from drop down.

- BRT – Basic Rate or non tax payer.

- HRT – Higher Rate tax payer.

- Mixed – joint applications with different tax bands. Few lenders distinguish the difference. Majority do not.

- ART – Additional Rate tax payer.

- LTD – purchases under a Limited Company.

B. Property Type

- SSC – Single Self Contained Unit

- Holiday Let Rent based – Short term lets where the loan is based on rent received.

- HMO – House of multiple occupation up to 6 bedrooms.

- MUFB – Multi Unit Freehold blocks up to 6 units.

- HMO 6 – 10 : House of multiple occupation with 7 to 10 beds.

- MUFB 6 – 10 : Multi unit freehold blocks with 7 to 10 units.

C. Transaction Types

- Purchase: where the transaction is purchase of a new BTL property.

- Let to Buy Resi 2 BTL: this is a remortgage transaction where the home owner wants to let the current property as a buy to let and purchase a new home to reside.

- Remo w Capital: where an existing buy to let property is remortgaged to raise capital. Rates and Rental calculation is same as for purchase.

- Remo £ for £: remortgage without capital raising. Many lenders have reduced ICR and stress rates giving higher loan amounts.

- Remo Bridge B4 6m: Specially useful for auction purchase properties with or without refurbishing. Excludes inherited property.

D. Client Type

- Homeowner : owner occupiers with at least one other BTL property. Owner occupiers purchasing first buy to let, use FTLL option.

- Consumer BTL : also called “accidental” landlords. Owner occupiers who needs to move but cannot sell current property. Some lenders does not allow a BTL remortgage where the applicant has lived.

- Expat: UK resident / citizens living and working abroad.

- FTB : First Time Buyers, applicants who do not currently own any other property, including their own residential. There is only a restricted number of lenders for these clients.

- FTB with HO : joint applications where one applicant is a property owner and the other does not own any other property. Most BTL lenders with treat them as home owner but there are exceptions.

- FTLL : First time landlord. Owner occupier purchasing first BTL property. There are few lenders that only lend to experienced landlords.

- Portfolio LL – eliminates lenders that do not lender to investors with greater than 4 BTL properties.

- Regulated BTL : purchase of a BTL for family member to live.

Manual Calculator – tool to further refine the results. Can be used with alternative products for each lender.

Section 3 : Rent from Loan and Loan from Rent

- To do this you will need the alternative product rate and its ICR rate. The stress rate for the lender can be obtained below from the Individual Lender Search section (5 & 6). Input the lender name to the search box to find the Stress rate for the lender.

- Calculate rent required: Often there is a need to identify if a property provides sufficient rent for the loan required. When the applicant is expecting a higher rent or the lender will use the market rent, instead of the AST rent ,this is a useful calculation.

Section 4 : individual lender research

- Fine-tune your product, research by comparing up to 4 lenders.

Section 5 : Results for individual lender search. Can quickly obtain result for any specific lender. Data is based on the full table. Therefore, the maximum fee limit set (Section 7) will affect the data. You may not see results here if the maximum fee is too low for the lender.

Section 6 : Will tell you if the loan required on manual calculator is too high for the rent.

Section 7 : Results – Maximum loan values can be arranged based on maximum fee level and/or rate. See video guide above. For all fee levels leave the “Choose Maximum Fee Limit” field blank.

Section 8 : Visual guide to distribution of loan in relation to fees

Graph1: Loan vs Fees – 2 year fixed rates. Shows for each 1% increase (up to 8%) in fees how the maximum loan varies.

Example based on Property: £550,000 / Rent: £1900 / LTV: 75% / Term: 25y / Client type: Experienced Landlord / Transaction: Purchase / Tax Band: LTD / Property type: Single Self Contained Unit

These visual guides are to help you to identify best possible loan based on the lowest fee. It also gives an indicator what to set the maximum fee filter. For example (from above graph) if the loan required is under 268,000 setting the “fee filter” to 7000 (2% fee) will generate all the lenders under this fee only.

Graph2: Loan vs Fees – 5 year fixed rates. Shows comparable results for the above example for 5 Year fixed rates. Provides a quick visual guide to available loan for each percentage of fee.

Graph3: Loan vs Fees – 5 year fixed rates for the same property as above but borrowing a lower loan.

In this image it can be easily visualised that for a lower loan/ LTV the required loan is achieved at a much lower fee, however, possibly with a higher rate.

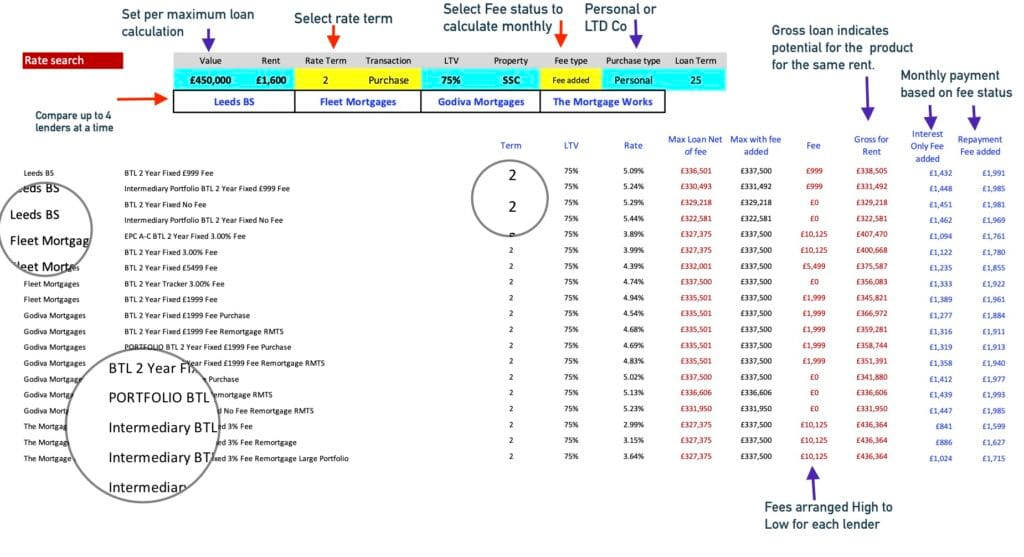

Section 9 : Whole market rates with loan amount – LATEST UPGRADE

You are not only able to obtain the maximum loan for your buy to let deals, you can now obtain the loan size, fees and the rates for over 50 lenders on our system. This latest upgrade will make the advisory process even more efficient for the brokers.

- Already pre-set: Property Value, Rent, LTV, Property Type, Purchase type (Personal or LTD Company and Loan term. These are as selected for loan calculator.

- Manual options: Rate Term (2 or 5 Yeas), Transaction type, Fee type (to be added or paid in advance).

- Lender Selection: choose from drop-down. There is a handful of lenders which are present in the maximum loan calculator but are not found in this module. These are mainly specialist lenders e.g. Gatehouse, Shawbrook.

The rate search module allows up to four lenders to be compare at a time instantly. Once your best lender options are identified from the maximum loan calculator, you can drill down to identify alternative products for each lender. It may reveal other rates with lower fees for the same scenario.

In this section section for each lender, products are arranged based on high to low fees. It also gives the monthly payment with and without fees.

Just remember this is a unique and a new development and will have few hiccups.

Therefore it is important to pay attention to all the criteria selected.

Section 10 : Lenders arranged in alphabetical order and cross match data (9)

For quick look up of lenders the results are also arranged in alphabetical order.

Searches are also interactive and the cross match data will give an indication when there are no results for a particular lender. For example the client type is cross matched with property type as well as transaction type. Many lenders need the applicant to be an experience landlord for HMO purchases. So for searches of FTLL x HMO only shows lenders that will allow the transaction.

Another example is Consumer BTL applicants. This type is purchasing a property for a family member to live. So all transactions related remortgaging will be excluded i.e. remo like for like, capital raising, from bridging etc.

Therefore it is important to pay attention to all the criteria selected.