Features

User friendly interface – identify lenders based on Tax Band, Property Type, Transaction & Client Type

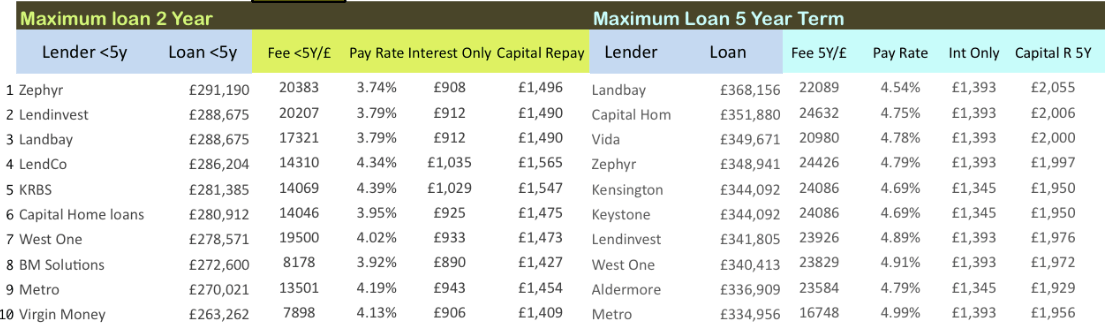

Top 10 lenders for maximum loan (8/8/2024) : Property Value £560,000 / LTV 75% / Rent £1950 / Higher Rate Tax Payer / Experience Landlord / Single Self Contained Unit / Transaction type – Purchase

Key Features and Benefits

- Comprehensive Coverage: Instantly compares maximum loan amounts from over 50+ lenders, delivering a broad range of options for brokers to discuss with clients on the spot.

- Instant, All-In-One Information: Displays loan limits, associated rates, fees, and monthly payment amounts simultaneously, enabling brokers to answer clients’ primary questions in a single view.

- Flexible Loan Filtering: Easily filters lenders based on fee structures, property type, client type, and more, allowing brokers to quickly adjust searches to match clients’ needs — from high-street lenders with lower fees to specialist lenders with low rates.

- Reverse Rent Calculation: Allows users to determine the rental income required to support a specific loan, making it ideal for investors seeking to release equity from existing properties.

- Efficiency in Client Interaction: Reduces the need for follow-up meetings, enabling brokers to respond to clients in real-time during face-to-face or live interactions and preventing the potential loss of clients to competitors who provide faster feedback.

- Instantaneous Results: Unlike other tools that rely on web scraping and suffer from inherent delays, this calculator provides instant feedback by using hard-coded rates, enhancing the broker’s ability to make decisions and respond swiftly.

Selection criteria 1

Tax band : No need to input income. For efficiency select Criteria based on The Application tax type – basic rate, Higher, mixed, additional or Limited company.

Selection criteria 2

Property type. Single self contained (SSC), House of multiple occupation (HMO), multi unit freehold building (mUFB) and holiday lets. The calculator Will filter rates and loan amount based On the property types.

Selection criteria 3

Transaction type: Purchase, remortgage with capital, like for like remortgage (L4L) and remortgage from bridging. This will identify those lenders with lower ICR and Stress rates for L4L lending.

Selection criteria 4

Client type: Differentiate between experienced landlords, First Time Buyers, expats, Regulated and Consumer buy to Let Clients. all controls are in the same outlay as the results so no need to switch pages.

Manual Calcualator

For ease of client servicing the manual calculator can be used to fine tune the calculation with other rates and fees, determine the rent required for loan etc. Once you identify a lender with the automated calculator, the manual calculator can check feasibility of the other options with the same lender.