Knowing your like for like remortgage lenders.

This knowledge can be crucial for some landlords. Not all lenders provide beneficial deals for remortgaging without capital raising. However, there is a group of lenders that use enhanced criteria, when there is no capital raising and therefor allow higher loan levels. Others makes no differentiation between standard remortgage rates and like for like (L4L). The result is that, affordability or maximum loan available is higher or the rates and fees are lower for L4L. However, it is wrong to assume that higher loan availability is purely based lower rates. Only a subset of lenders offer lower rates for L4L. Other have the same pay rates as standard, but lower ICR or stress rates for L4L. So the result can be a higher loan with both groups.

When the existing product is coming to an end, this can play a crucial role in the decisions a landlords needs to make. Because, the affect of L4L remortgaging on loan size can be significant for rates under 5 year terms. In the current economic cycle many landlords are unsure whether to risk a 2 year term or err on safety, and fix for 5 years, as there is no clear indication from the Bank of England whether the rates will fall appreciably in the next couple of years.

Higher loans can also help buy to let mortgage prisoners, such as those landlords who are unable to increase their rents.

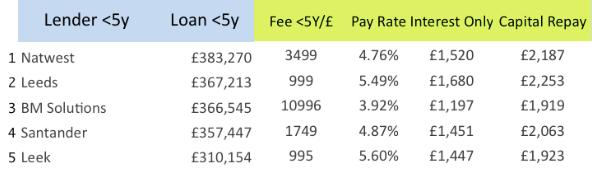

Above are lenders with maximum loan based on middle range fees, i.e. fees below £12,000 or 3.5%. There are deals up to 7% fees, which have been excluded. Criteria : Example based on Date 18/8/24 ; Value £600,000, LTV 75%, Rent £2100, Term 25 years, Basic Rate Tax payer, Experience landlord, Property – Single self contained unit, Transaction – Like of like remortgage, Rate term 2 years.

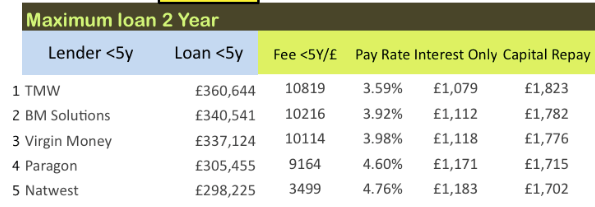

For under 5 year fixed rate deals, the difference between like for like and remortgage with capital raising is substantial. For 5 year fixed rates not so. Compare below the loan level for remortgaging with capital raising for the same scenario.

Here the maximum loan is much lower and more significantly, to get near identical loan levels, the investor will need to pay much higher fees. Some of the high street lenders such as Natwest, Leeds, Santander and BM show enhanced product criteria, when it is like for like remortgaging. They use lower stress rates when there is no capital raising.

Patently, if the lowest rate is the requirement, remortgaging on a non-specific deal such as with TMW will be the better option.

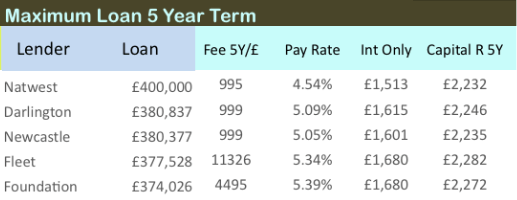

Like for like remortgage highest loan 5 Year fixed rates. Scenario as above.

So when you are dealing with L4L remortgages it is important to analyse lender’s ICR and stress rate carefully. It may be the different between getting a remortgage through when the rental income is tight or when the landlord is looking to benefit from falling rates.

If you interested in the tool used for these analysis, take a free trial on this website or watch a video of it’s use here www.axessmax.com