Buy to Let rates under 4%

Competition among lenders are brewing and can we expect the rates fall further. It was big news when residential rates fell below 4% recently. However, below 4% rates have been available to BTL borrowers for a longer period, with some of the specialist lenders. Three lenders currently offering below 4% on 2 year deals at 75% LTV are TMW, MT-Finance and Lendinvest with fees of 3%, 7%, 7% respectively.

At 70% however, more lenders come in to play. Capital Home Loans, Zephyr, Paragon and Keystone all have under 4% 2 year deals. Fees of 7%, 5%, 7% and 7% respectively.

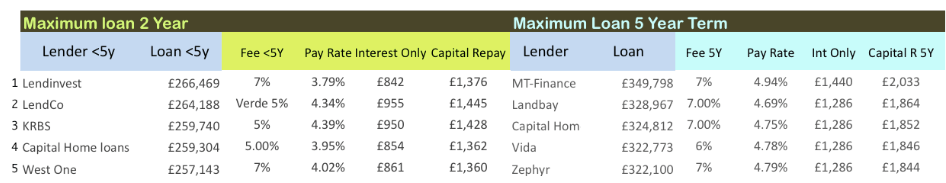

Bellow is Top 5 lenders at 75% LTV for both 2 and 5 years.

| Property Value: | £500,000 | Rent: | £1,800 |

| LTV: | 75% | Term/ years: | 25 |

| Applicant Tax Band: | Higher Rate | Property type: | SSC |

| Transaction type: | Purchase | Applicant: | Experienced Landlord |

For 5 year fixed deals as far as we can see only TMW are offering below 4% deal, with a fee of 3%.

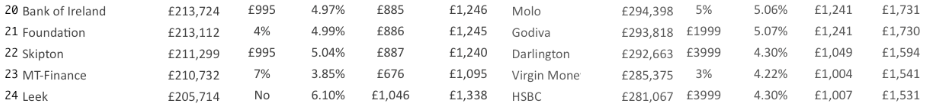

Middle ranking lenders for the same scenario is as follows. Much lower fees can be accessed as expected among these. However some of the specialist lenders like Foundation and MT-Finance are still maintaining higher fees even at this level of lending.

There is lot of talk about swap rates and their impact on fixed rate mortgages. Even with the falling swap rates many of the buy to let rates have been held higher by many lenders. As always every buy to let applicant wants you to read the crystal ball and say when the rates will fall.

2 Year Fixed

5 Year Fixed